As the trading world evolves, so do the platforms that fuel the trading journey of millions across the globe. MetaTrader has long been a staple for traders, but the landscape is shifting, and more-modern and feature-rich platforms are making significant strides.

This blog post aims to explore the best MetaTrader alternatives for 2024 and beyond. Before we dive in, let’s take a look at what the up-and-coming rivals are: TradeLocker emerges as the fastest-rising star, joined by cTrader, NinjaTrader, thinkorswim, and ThinkMarkets.

Let’s get the full picture and go for a walk around these platforms and their unique offerings.

TradeLocker: The Fast-Rising Star

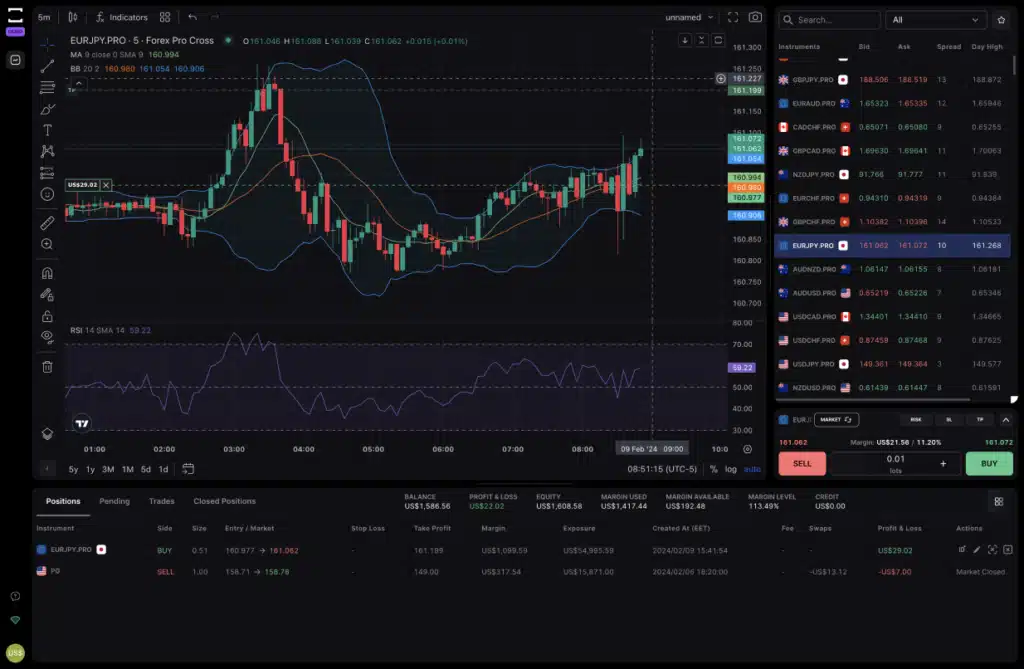

TradeLocker is quickly becoming the go-to choice for brokers and proprietary trading firms seeking to move away from legacy platforms. Its rapid adoption can be attributed to its innovative features, such as on-chart trading, charting by TradingView and a highly intuitive user interface.

TradeLocker is powered by TradingView charting and is designed with the future of trading in mind, aiming to provide financial empowerment through its revolutionary trading tools.

Pros:

– Backtesting included in TradeLocker Alpha

– Risk management tools included

– Lot calculator included

Cons:

– Bots have just been released and should be on the live server by late March.

Experience the next-generation of trading with TradeLocker—visit their official website.

cTrader: Customization in Mind

cTrader stands out for its high level of customization and advanced trading capabilities. It is favored by traders who seek detailed charting tools and algorithmic trading options.

cTrader also offers more than 50 pre-installed indicators and charting templates. This makes it a convenient option for market enthusiasts looking for a wide array of tools.

Pros:

- Advanced charting and algorithmic trading capabilities.

- Highly customizable trading experience.

- More than 50 pre-installed indicators.

Cons:

May have a steeper learning curve for new traders.

NinjaTrader: The Analytical Platform

NinjaTrader is renowned for its advanced analytical tools and comprehensive market data. It caters to active traders looking for detailed analysis mainly on futures markets. NinjaTrader also offers a free version with limited features, making it accessible to traders at all levels.

Pros:

- High-end analytical tools and data.

- Plenty of trading indicators.

- Excellent backtesting capabilities.

Cons:

- Full features are less user-friendly than those offered by competitors.

thinkorswim: The All-Rounder

thinkorswim, by TD Ameritrade, is a powerhouse for traders who demand a wide array of tools spanning from charting to risk analysis. It’s particularly known for its options trading features. The platform provides extensive resources for education and research, making it a great all-rounder for beginners and experienced traders alike.

Pros:

- Extensive tools for charting and risk analysis.

- Exceptional options trading features.

- Comprehensive educational resources.

Cons:

- Can be overwhelming for beginners due to its vast array of features.

ThinkMarkets: The Innovative Platform

ThinkMarkets offers a unique proposition by combining brokerage services with innovative trading technology. Its platform is designed for both beginner and experienced traders, offering a balance between ease of use and advanced features. ThinkMarkets is popular for its robust security measures and customer service.

Pros:

- Balances ease of use with advanced features.

- Strong focus on security and customer service.

- Suitable for traders at all levels.

Cons:

- Broker-centric, which may limit platform choices.

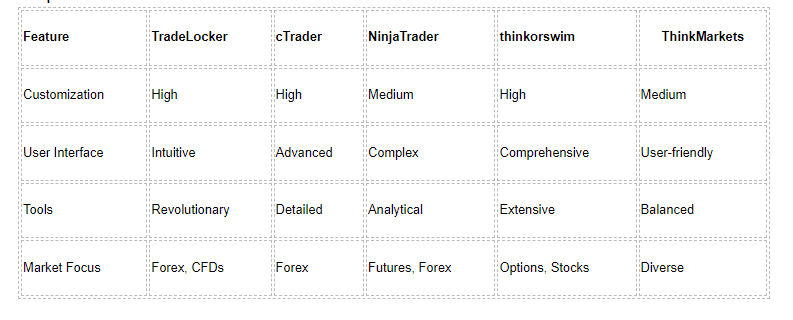

Comparison Table

Summary

Each of these platforms brings something unique to the table, catering to different trader needs and preferences. TradeLocker‘s rapid rise and adoption signify a shift towards more innovative and user-centric trading solutions, challenging the traditional dominance of MetaTrader.

As trading platforms continue to evolve, the choice ultimately rests with individual traders and their specific needs, ensuring that the trading experience is as efficient and effective as possible.