The Hidden Triangle: How 3 Simple Rules Separate Profitable Traders from Gamblers

Profitable Trading System in a Nutshell:

✓ The #1 mistake that destroys 95% of trading accounts (and how to avoid it with a profitable trading system)

✓ The 3-corner triangle system that eliminates emotional trading forever

✓ Dynamic risk management that adapts to market conditions automatically

✓ Real trade example showing the complete system in action

✓ Why simple systematic approaches outperform complex strategies

✓ How to transition from gambling to a professional trading mindset

At 2 AM, another trader stares at their screen. Red numbers. Another losing streak. Another blown account. Another night wondering why their market analysis looks brilliant on paper but crumbles when real money hits the line.

Sound familiar?

Here’s the brutal truth: 95% of traders lose money not because they lack intelligence or market knowledge, but because they approach trading like a casino game instead of a systematic business.

Meanwhile, a small group consistently generates profits using a framework so simple it can be drawn as a triangle. Trader Dovy used this exact methodology to turn $25,000 into $250,000 in just four months with verified, public results.

This is the systematic approach that separates profitable traders from gamblers.

The Critical Mistake Most Traders Make

Walk into any trading community and you’ll see the same pattern: traders obsessing over the latest indicator, chasing perfect entry signals, or following some guru’s “guaranteed system.”

They collect strategies like trophies but remain consistently unprofitable.

The mistake? Learning individual trade setups without understanding complete systems.

Students master technical patterns but panic when trades move against them. They perfect entry techniques but have no systematic approach to risk management. They analyze charts beautifully but make emotional exits that destroy profits.

Real profitable trading isn’t about finding perfect setups—it’s about having a complete business framework that handles every aspect from entry to exit. Just like successful prop trading firms use systematic approaches to manage risk and generate consistent returns.

Now that you understand the fundamental problem, let’s dive into the solution that’s been hiding in plain sight. The answer lies in a simple geometric shape that transforms chaotic trading into systematic business.

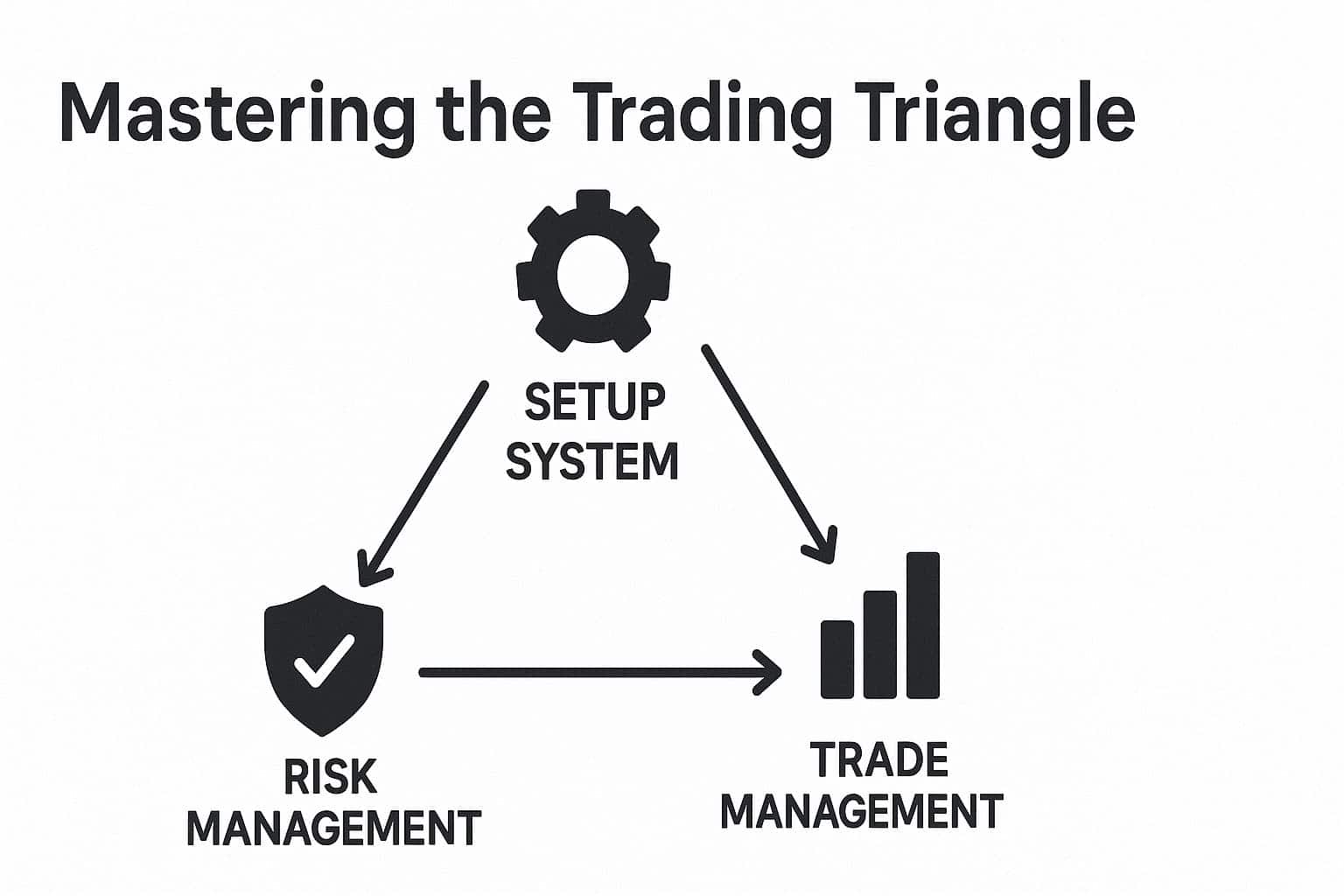

The Profitable Traders Triangle: Three Rules That Change Everything

Successful traders follow a systematic framework called the “Profitable Traders Triangle”—three interconnected rules that transform trading from gambling into predictable business.

This isn’t just another strategy, it’s the same type of systematic business approach that successful entrepreneurs use to build profitable ventures.

Corner 1: The Setup System That Eliminates Guesswork

Professional traders follow a three-step process for every single trade:

Step 1: Build Your Weekly Direction

- Look at last week’s price movement

- If the previous weekly candle went up, next week is statistically more likely to go up

- This creates directional bias for all your trading decisions

- Simple but powerful trend-following principle

Step 2: Find Your Key Price Zones

- Focus only on active market hours (London and New York sessions)

- Locate areas where the price previously bounced strongly

- Avoid trading during dead hours when nothing happens

- Use session indicators to identify high-probability time windows

Step 3: Wait for Entry Confirmation

- Drop to shorter timeframes for precision timing

- Never enter without confirmation signals:

- Double bottoms breaking higher

- Clean breakouts of resistance

- Clear reversal patterns

- Patience eliminates emotional, fear-driven entries

With your setup system established, the next critical element separates amateur traders from professionals. Most traders use the same risk on every trade, which is a costly mistake that professional fund managers never make.

Corner 2: Smart Money Risk Management

Here’s where profitable traders separate themselves from the crowd. Instead of using the same risk percentage for every trade, professionals adjust based on market conditions:

Daily Market Structure Check:

- ✓ Is the overall trend moving in your direction?

- ✓ Are key support/resistance levels holding?

- ✓ When everything aligns: use full risk (typically 3%)

- ✓ When structure shows weakness: reduce exposure

Short-Term Momentum Assessment:

- Check 15-minute charts for immediate price direction

- If momentum fights against your trade direction: reduce risk from 3% to 2%

- This simple adjustment protects capital when short-term action conflicts with longer-term direction

- Flow with the market instead of fighting it

Result: Dynamic risk management that adapts to changing conditions.

You now have systematic entry rules and dynamic risk management. But here’s where most traders still fail: they have no plan for managing trades once they’re live. The final corner of the triangle solves this completely.

Corner 3: The Millionaire’s Trade Management Secret

Core principle: “Professional traders don’t guess what will happen instead they react to what IS happening.”

The Process:

- Before entering any trade: Identify previous price rejection areas between your entry and target

- These are zones where price struggled before and might struggle again

- Don’t try to predict what happens instead prepare to react based on what the market shows you

Management Rules:

- ✓ Price breaks through rejection zone cleanly → Hold full position

- ✓ Price shows hesitation or reversal signals → Consider taking partial profits

- ✓ Always react to market behavior, never hope or guess

This systematic approach removes emotion and creates consistent decision-making under pressure.

Theory is valuable, but seeing the complete system in action makes everything click. Let me show you exactly how this triangle framework played out in a real trade with real money.

Real-World Application: The Live Trade Example

Here’s how this works in practice with an actual trade:

Setup Phase:

- ✓ Weekly direction: Consistent upward movement over multiple weeks

- ✓ Key price zone: Strong bounce area identified during New York trading hours

- ✓ Entry confirmation: Double bottom pattern with clear breakout signal

Risk Management Phase:

- ✓ Daily structure: Overall trend moving upward (green light for 3% risk)

- ✓ Short-term momentum: Strong downward pressure approaching the level

- ✓ Decision: Risk reduced to 2% due to conflicting momentum

Trade Management Phase:

- ✓ Two rejection zones identified between entry and target

- ✓ First zone: Price broke through without hesitation → Position held

- ✓ Second zone: Brief resistance but continued higher → Full target reached

Every decision was rule-based, not emotional.

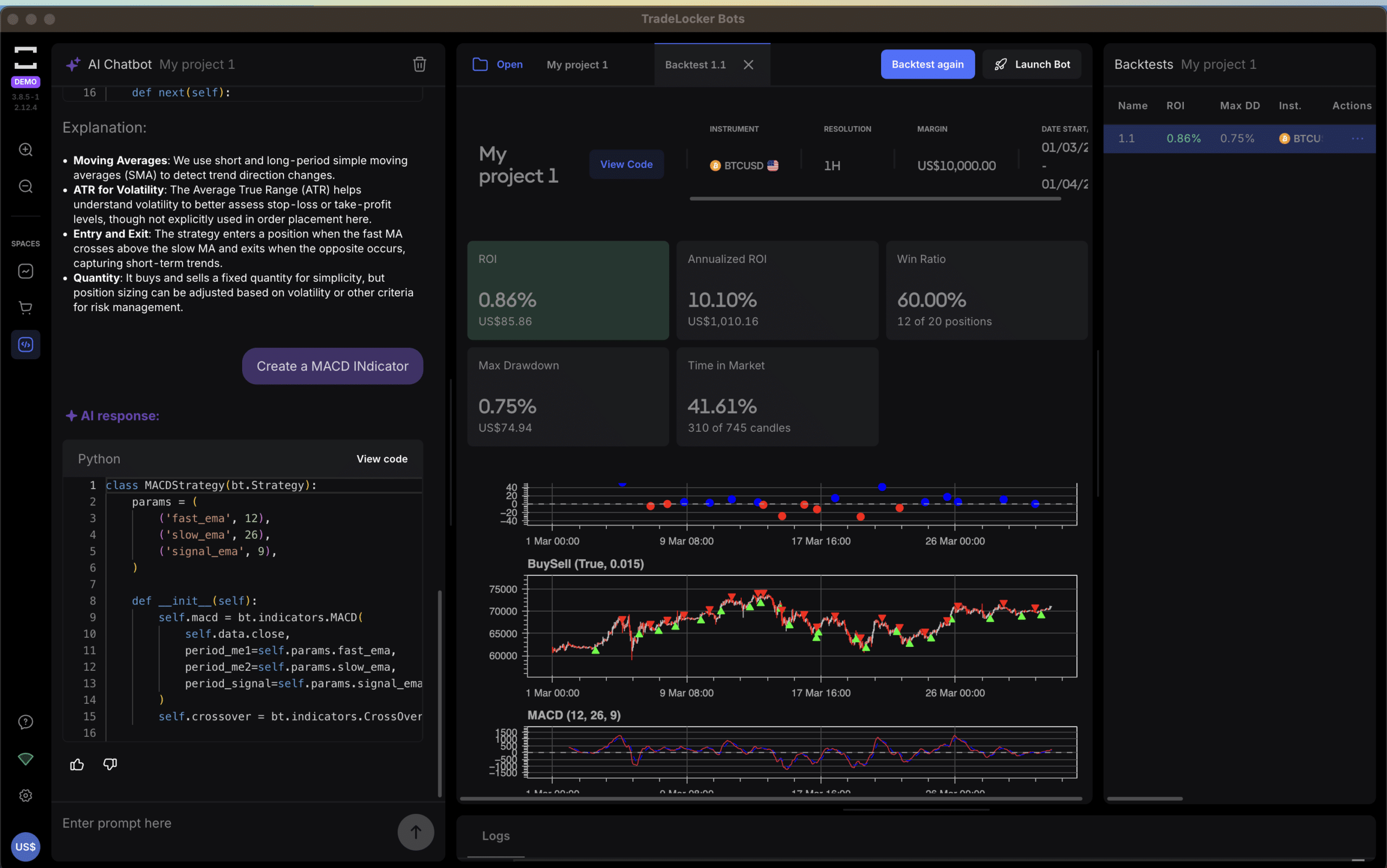

[Watch the complete trade breakdown: https://www.youtube.com/watch?v=ibXwMs4Kzwo&t=180s]

Ready to implement this complete system yourself? The triangle framework you just learned is the foundation, but mastering the nuances takes guided practice. See if you qualify for personalized mentorship: Apply Here

You might be wondering why such a simple system works when complex strategies fail. The answer lies in human psychology and market mechanics that never change.

Why This System Actually Works

The triangle eliminates three factors that destroy most trading accounts:

✓ Systematic Consistency

- Same process every single trading day

- No guesswork or strategy changes based on last week’s results

- Clear rules for every decision

✓ Emotion Elimination

- Predetermined rules prevent fear and greed from derailing decisions

- No more panic exits or FOMO entries

- Confidence comes from following a proven process

✓ Capital Protection

- Dynamic risk management preserves accounts during unfavorable conditions

- Smaller losses during tough periods

- Bigger positions during ideal setups

The Result: This scales from small accounts to large accounts because it’s percentage-based, not fixed dollar amounts.

This mirrors the same growth strategies that successful businesses use to scale systematically while managing risk.

Understanding why the system works is important, but knowing what happens behind the scenes in professional trading reveals why most retail education fails completely.

The Underground Reality

Here’s what the trading industry doesn’t want you to know: most successful traders use systematic frameworks exactly like this triangle.

They don’t rely on:

- ❌ Magical indicators

- ❌ Gut feelings

- ❌ Secret strategies

- ❌ Perfect market timing

They DO rely on:

- ✓ Clear processes

- ✓ Risk controls

- ✓ Systematic execution

- ✓ Business-like approach

The catch: Systematic approaches don’t sell as well as dreams of easy money. It’s easier to market “foolproof systems” than teach disciplined methodology.

The reality: Profitable trading requires just one focused hour daily—but that hour must be systematic, disciplined, and consistent.

Just like building any successful fintech ecosystem, consistent execution of proven processes beats sporadic brilliance every time.

The triangle system is powerful, but it’s just the beginning. Professional traders use additional layers and advanced techniques that take the foundation you’ve learned to institutional levels.

Taking It to the Next Level

The triangle you just learned is powerful, but it’s the foundation. The complete system includes:

- Advanced multi-timeframe analysis

- Psychology management techniques

- Market sector rotation strategies

- Professional trade journaling methods

The Hidden Edge is a comprehensive one-on-one mentorship where you learn the complete system directly from Dovy, who has publicly verified these results month after month.

Current Student Results:

- ✓ Faharan: $4,000 monthly profits

- ✓ Houssam: $11,300 single trade result

- ✓ Multiple students achieving consistent profitability

What You Get:

- 90-day pathway to consistent profitability

- Personal guidance from a verified successful trader

- Complete system implementation

- Ongoing support and feedback

Requirements: Only for traders committed to treating this like a business, dedicating one hour daily and following systematic principles without deviation.

Every trader faces this moment: continue the cycle of hoping and gambling, or commit to the systematic approach that actually works. Your choice here determines everything that follows.

The Choice Is Yours

You now understand the three corners that separate profitable traders from gamblers:

- Systematic setup identification

- Dynamic risk management

- Rule-based trade management

Most traders will read this, nod their heads, and continue chasing the next hot strategy.

But a small percentage will recognize the power of systematic trading and commit to implementing these principles consistently. Those traders join the 5% who actually make money in the markets.

Trading isn’t about luck, intuition, or finding perfect indicators.

It’s about having a proven system and executing it with disciplined consistency.

Ready to stop gambling and start trading like a business?

Apply for The Hidden Edge Mentorship. The systematic approach to profitable trading is waiting for you. The question is: are you ready to commit to it?