Key Factors to Consider When Setting Up Your Own Forex Broker

Setting up your own Forex broker is a significant undertaking that requires a strategic approach and thorough planning. Discover the key factors to consider to ensure the success and longevity of your Forex broker.

Strategic Market Positioning

Strategic market positioning is crucial for differentiating your Forex broker in a competitive landscape. Identify your target market—be it retail traders, institutional clients, or high-net-worth individuals—and develop a unique value proposition. This could include exclusive trading tools, superior customer service, or advanced analytics. By clearly defining your niche and value proposition, you can attract and retain clients more effectively.

Mission

Your mission statement should clearly articulate the purpose of your Forex broker. It defines why your company exists and what it aims to achieve in the market. A well-crafted mission statement guides your strategic decisions and helps communicate your business’s core values to clients, partners, and stakeholders.

Vision

The vision statement of your Forex broker outlines the long-term aspirations and desired future position of your company. It serves as a motivational tool, inspiring your team and stakeholders to work towards common goals. Your vision should be ambitious yet achievable, providing a clear direction for growth and development.

Goals

Setting clear and measurable goals is essential for tracking the progress of your Forex broker. These goals should align with your mission and vision and cover various aspects of your business, such as client acquisition, market expansion, revenue targets, and service quality. Regularly reviewing and adjusting these goals ensures that your broker stays on track and adapts to changing market conditions.

Risk Management

Effective risk management strategies are crucial for protecting your broker from significant losses. Implement automated risk management systems to monitor and control exposure in real-time. Tools such as margin calls, stop-loss orders, and automated trading systems are essential for managing risks effectively.

Customer Support

Providing exceptional customer support is critical for client satisfaction and retention. Offer multi-lingual support via live chat, email, and phone. Ensure your support team is well-trained and capable of resolving issues promptly.

Finding the Right Partner

Choosing the right partner is crucial for the success of your Forex broker. This includes selecting a reliable liquidity provider and technology provider. A strong partnership with top-tier liquidity providers ensures tight spreads and efficient trade execution. Partnering with experienced technology providers guarantees a robust and user-friendly trading platform.

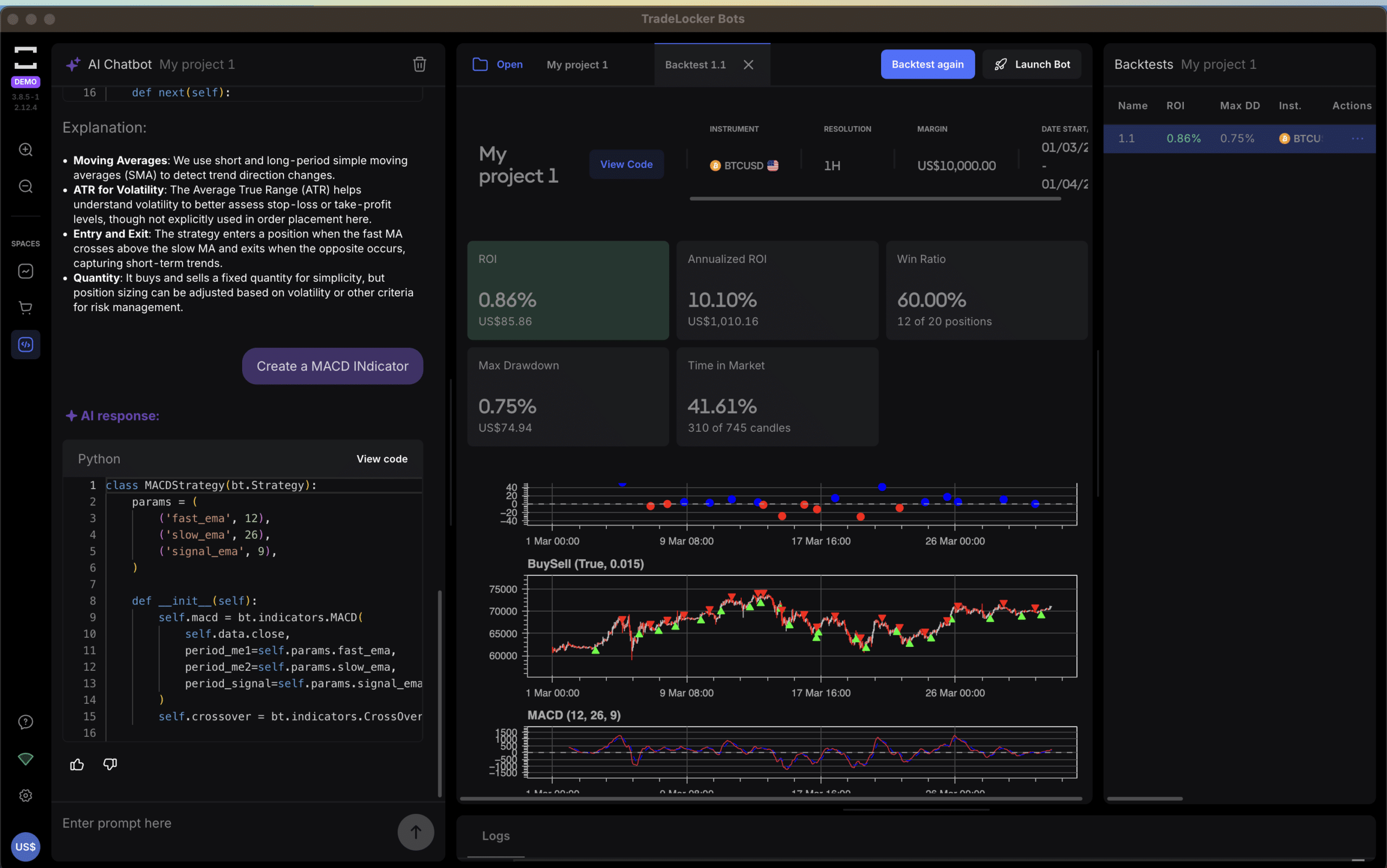

Benefits of White-Label Solutions

White-label solutions offer a cost-effective and efficient way to set up your Forex broker. By leveraging a plug-and-play platform, you can quickly enter the market without the need for extensive development. White-label solutions provide a customizable trading platform under your brand, allowing you to focus on client acquisition and growing your business without thinking about things like marketing, web development, customer support, and more.

Ready to Start Your Own Forex Broker?

Establishing a Forex broker involves a comprehensive understanding of market positioning, technology, risk management, and customer service. By focusing on these key factors and leveraging the benefits of white-label solutions, you can build a successful and sustainable Forex broker that meets the needs of traders and stands out in a competitive market.

Reach out to Owen.com and let’s kick off your journey to becoming a full-fledged forex broker!