Starting Your Own Forex Broker Business: The Complete Guide for 2025

The forex market reigns as the world’s largest and most liquid financial market, with daily trading volumes exceeding $7 trillion. While millions focus on trading currencies, a lucrative opportunity lies in becoming the broker facilitating these trades. With the right approach and modern turnkey solutions, launching your own forex brokerage has never been more accessible or profitable.

Key Points

- Massive Market Opportunity: The forex market generates over $7 trillion in daily volume with 300 million retail traders served by approximately 4,000 brokers worldwide

- High Profit Potential: Average brokers earn $500,000 to $1 million annually, with senior portfolio managers exceeding $10 million per year

- Multiple Revenue Streams: Generate income through spreads, commissions, fees, and additional services rather than relying solely on trading profits

- 24/5 Operations: Unlike stock markets, forex operates around the clock, creating constant revenue opportunities

- Scalable Business Model: Expand client base, enter new markets, and diversify revenue streams for long-term growth

- Turnkey Solutions Available: White-label providers can launch your brokerage in weeks for $7,000-$40,000 versus $100,000+ for independent development

- Regulatory Compliance Required: Proper licensing and compliance are essential for building trust and long-term success

Understanding the Forex Market Opportunity

The forex market’s massive scale presents unparalleled business opportunities. With over $6-7 trillion in daily turnover and an estimated 300 million retail traders served by approximately 4,000 brokers worldwide, the numbers speak for themselves.

Several factors drive the growing demand for forex trading:

Globalization: Increasing international trade and investments necessitate currency exchanges, continuously boosting forex market activity.

Technological Advancements: Online trading platforms and mobile apps have made forex trading accessible to retail traders worldwide.

24/5 Market Operations: Unlike stock markets bound by trading hours, forex markets operate 24 hours a day, five days a week, creating constant revenue opportunities.

Types of Broker Business Models

Understanding different broker models is crucial for positioning your business correctly. Each model comes with distinct advantages and challenges:

Online Brokers

Discount Brokers

Pros:

- Lower costs with competitive commission rates and minimal fees

- Independent trading with full portfolio control

- Wide market access to stocks, bonds, options, and ETFs

- Attractive to entry-level investors seeking affordability

Cons:

- Limited support with little to no investment advice

- Basic trading tools lacking advanced features

- Impersonal service without detailed financial planning

- Clients assume full responsibility for trading decisions

Direct Access Brokers

Pros:

- Direct market connection with powerful trading software

- Sophisticated execution tools for institutional-level trading

- High-speed order execution for active traders

- Advanced features for complex trading strategies

Cons:

- Higher costs due to premium features and technology

- Complexity requiring significant trading knowledge

- Limited to experienced traders and institutions

- Steep learning curve for platform utilization

Robo-Advisors

Pros:

- Automated portfolio management based on algorithms

- Lower fees compared to traditional advisory services

- Passive investment approach with broad market exposure

- Suitable for hands-off, long-term investors

Cons:

- Limited customization due to preset algorithms

- Lack of human touch and emotional support

- Complex technology that may confuse less tech-savvy users

- Restricted to algorithmic investment strategies

Traditional Brokers

Full-Service Brokers

Pros:

- Personalized advice tailored to individual risk tolerance

- Access to detailed analytics and expert market insights

- Comprehensive services including retirement and estate planning

- Dedicated relationship management for high-value clients

Cons:

- Higher fees and commissions for comprehensive services

- Less client autonomy with heavy reliance on broker recommendations

- Minimum account requirements that may exclude smaller investors

- Potentially slower execution compared to online platforms

Traditional Brick-and-Mortar Brokers

Pros:

- Face-to-face consultations for important financial decisions

- Personal relationships with dedicated financial advisors

- Comprehensive financial planning beyond trading

- Trust factor for clients preferring in-person service

Cons:

- Limited accessibility with restricted office hours

- Higher operational costs passed to clients

- Slower execution compared to online alternatives

- Declining market relevance in digital age

Key Benefits of Starting Your Own Forex Broker

High Profit Potential and Multiple Revenue Streams

Forex brokers generate income through various channels:

- Spreads: The difference between bid and ask prices on currency pairs

- Commission Fees: Charges per trade or per lot traded

- Additional Services: Account management fees, premium features, and value-added services

Recurring Revenue Model

Unlike individual traders who depend on market movements, brokers benefit from each trade made by their clients. With forex trading active 24/5, brokers enjoy virtually constant earning opportunities and steady transaction flows.

Scalability and Growth Potential

As your client base grows, so do your earnings. The massive global forex market provides an endless pool of potential clients, allowing for substantial business scaling. Successful brokerage businesses can expand into new markets and diversify revenue models to protect against market volatility.

Flexibility and Control

Running your own forex broker provides unmatched business control:

- Complete Marketing Control: Position your brokerage to stand out through targeted advertising, social media marketing, and strategic partnerships

- Regulatory Advantages: Choose favorable jurisdictions with supportive regulatory frameworks, lower operational costs, and streamlined licensing processes

- Business Model Customization: Set your own spreads, commission structures, and service offerings

Step-by-Step Launch Guide

1. Conduct Comprehensive Market Research

Identify your target audience, assess competition, and analyze current industry trends. If you come from a trading background, consider what features you would want in your ideal broker. Understanding your market is crucial for platform optimization and client acquisition.

2. Obtain Regulatory Approval

Regulatory compliance is complex but essential for building trust and long-term client relationships. Requirements vary by jurisdiction, but transparency and proper licensing are fundamental to credible broker operations.

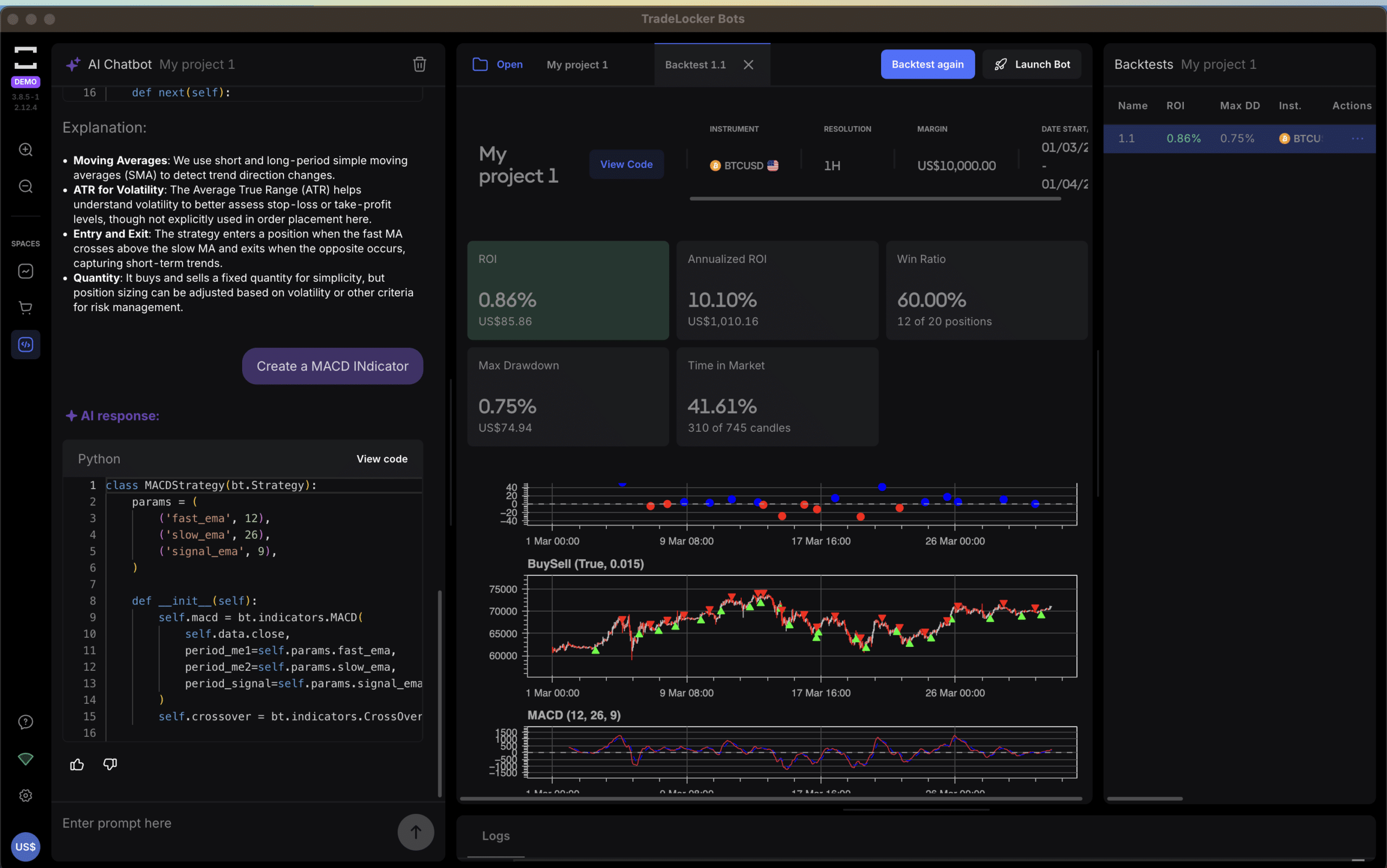

3. Choose Your Trading Platform

Your trading platform serves as your business foundation. Ensure robust trading features, intuitive user interfaces, and fast performance. Consider adding charting capabilities, mobile functionality, and advanced analytical tools to attract sophisticated traders.

4. Secure Reliable Liquidity Providers

Partner with top-tier liquidity providers to ensure fast execution and competitive pricing for your clients. Quality liquidity connections directly impact client satisfaction and retention.

5. Implement SEO and Digital Marketing

Visibility is critical in the digital world. Optimize your platform for search engines using relevant keywords, publish high-quality content regularly, and implement targeted marketing strategies to reach your ideal audience.

6. Establish Exceptional Customer Service

Provide multiple support channels (live chat, email, phone calls) and ensure your clients feel valued and respected. Outstanding customer service differentiates your brokerage from competitors and builds long-term loyalty.

7. Set Up Secure Payment Systems

Partner with reliable payment providers and offer various deposit/withdrawal methods (credit cards, bank transfers, digital wallets). Emphasize robust security measures and data encryption to build client confidence.

Build vs Buy: White-Label Solutions vs Independent Development

Building From Scratch

Pros:

- Complete customization and control over technology architecture

- Unique competitive advantages through proprietary features

- No dependency on third-party providers for core operations

- Full ownership of intellectual property and platform development

Cons:

- Significant initial investment ($100,000-$300,000+)

- Extended development timeline (6-18 months)

- Complex regulatory navigation without expert guidance

- Ongoing technical maintenance and upgrade responsibilities

- Higher risk of technical failures and security vulnerabilities

Cost Breakdown:

- Initial Investment: $5,000 to $150,000 for startup fees and overheads

- MetaTrader 4 License: $100,000 to $150,000 annually

- Monthly Operations: Around $100,000

- Broker Licensing: $7,500-$55,000

- Technology Development: $8,000-$30,000

- Legal and Accounting: $6,000-$25,000

- Staff Salaries: Average $72,000 for US brokers

White-Label Solutions

Pros:

- Time-Saving: Launch in weeks rather than months with pre-built platforms

- Cost-Efficient: Lower initial investment ($7,000-$40,000) with faster profitability

- Regulatory Compliance: Professional handling of complex requirements with ongoing updates

- Technical Support: Expert teams handle platform maintenance and security

- Proven Technology: Battle-tested platforms with established track records

- Faster Market Entry: Immediate access to trading infrastructure and liquidity

Cons:

- Limited Customization: Restricted to provider’s technology and branding options

- Provider Dependency: Reliance on third parties for maintenance, upgrades, and support

- Increased Competition: Popular solutions may result in similar competitor offerings

- Ongoing Fees: Monthly costs for platform usage and support services

- Less Control: Limited ability to modify core platform functionality

Included Services:

- Trading software (TradeLocker or MT4/MT5)

- Liquidity for multiple assets and currency pairs

- CRM (customer relationship management) platform

- Multi-trading functionality (PAMM/social trading/copy trading)

- Varied deposit and withdrawal methods

- 24/7 customer support

Conclusion:

With average brokers earning $500K-$1M annually and the market growing exponentially, the forex brokerage opportunity is undeniable. The only question is whether you’ll seize it now or regret missing it later.

Turn your forex knowledge into a million-dollar business. Owen.com eliminates every barrier standing between you and forex brokerage success. No coding. No regulatory headaches. No months of waiting. Just your branded platform, ready to generate revenue from day one.