MAM Account : Multi-Account Manager account

What is a MAM Account or Multi Account Manager Account?

A Multi-Account Manager account (MAM Account) is a specialised trading solution that enables professional traders or fund managers to manage multiple individual trading accounts simultaneously from a single master account. This setup is particularly beneficial in the forex market, where efficiency and precision are paramount.

How Multi Account Manager Accounts Operate

In a MAM arrangement, the fund manager operates a master account linked to several sub-accounts owned by individual investors. When the manager executes a trade in the master account, the same trade is proportionally replicated across all linked sub-accounts based on predefined allocation methods.This proportional distribution ensures that each investor’s account reflects the master account’s performance in alignment with their investment size.

Key Features

– Flexible Allocation Methods: MAM accounts offer various allocation methods, such as lot allocation, percentage allocation, and equity-based allocation, allowing fund managers to tailor strategies to individual investor preferences.

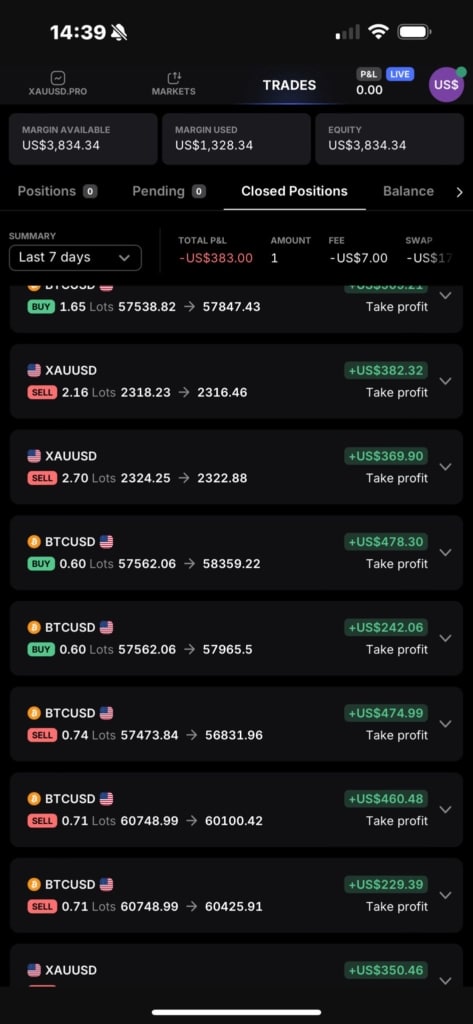

– Real-Time Reporting: Both managers and investors have access to real-time reporting tools, providing transparency and enabling informed decision-making.

– Risk Management: Fund managers can implement risk management strategies across all sub-accounts, ensuring consistent application of risk controls.

– Customization: MAM accounts support using Expert Advisors (EAs) and other trading tools, facilitating the implementation of diverse trading strategies.

Benefits for Investors

– Professional Management: Investors can leverage the expertise of seasoned traders without actively managing their accounts.

– Diversification: By participating in a MAM account, investors can diversify their portfolios across various trading strategies and instruments.

– Transparency: Investors have real-time access to their account performance, fostering trust and confidence in the fund manager’s decisions.

Advantages for Fund Managers

– Scalability: MAM accounts enable fund managers to efficiently handle multiple client accounts, expanding their client base without compromising service quality.

– Efficiency: Executing trades from a single master account reduces administrative overhead and minimizes the potential for errors.

– Performance-Based Compensation: Fund managers can structure compensation based on performance fees, aligning their interests with those of their clients.

Considerations When Choosing

– Regulatory Compliance: Ensure that the broker offering the MAM account is regulated by a reputable financial authority to safeguard investor interests.

– Broker Reputation: Research the broker’s track record, client reviews, and industry standing to assess reliability and trustworthiness.

– Trading Platform Compatibility: Verify that the MAM account integrates seamlessly with preferred trading platforms, such as MetaTrader 4 or 5, to ensure a smooth trading experience.

– Fee Structure: Understand the fee structure, including management fees, performance fees, and any additional costs, to evaluate the overall cost-effectiveness of the MAM account.

Opening a Multi Account Manger Account

To open a account, follow these general steps:

1. Select a Reputable Broker: Choose a broker that offers MAM account services and aligns with your trading needs and regulatory requirements.

2. Complete the Application Process: Submit the necessary documentation and information as required by the broker to establish the master account.

3. Link Sub-Accounts: Coordinate with your clients to link their individual trading accounts to the master account.

4. Define Allocation Methods: Set up the preferred allocation methods to distribute trades across sub-accounts according to client agreements.

5. Begin Trading: Once the setup is complete, you can start executing trades from the master account, which will be mirrored in the linked sub-accounts.

MAM accounts offer a robust solution for fund managers aiming to efficiently manage multiple client portfolios and for investors seeking professional management of their trading accounts.By providing a structured and transparent framework, MAM accounts facilitate a collaborative approach to trading, benefiting both managers and investors.

Multi Account Manager Account