How to Manage Risk as a Trader in Financial Markets

Key Takeaways:

- Risk management in trading will protect your account and help you grow your funds.

- Best practices include having a trading strategy and using the right tools like a risk calculator.

What is risk management in financial markets?

Risk management in financial markets is a technique aimed at protecting your account from losses. More specifically, risk management refers to all strategies, tools, and approaches you use to identify and evaluate risks in trading and investing.

Risk management should be closely tied to any trade you open so you could make sure all your positions are under control. In other words, you guarantee that no single position could wipe out significant amounts of money from your account.

Moreover, by using proper risk management, you take uncertainty away from trading and ensure your funds are safe.

Why is risk management important in trading?

In trading and investing, the way you handle risks will mean whether you win or lose. That’s why risk management is crucial when you set out for your trading endeavors. Not only does risk management evaluate the downside in any trade, but it also aims to catch the most upside possible.

Put simply, risk management minimizes losses, and maximizes profits. As a trader or investor, you will be faced with multiple opportunities to enter the market every single day. Thanks to risk management, you can be certain your account will endure even the worst of storms.

And because global financial markets are complex and involve countless factors at play, there will be lots of financial storms.

10 rules of proper risk management

When you want to get in the markets and turn a profit, it’s important to keep in mind these 10 rules of proper risk management.

- Never risk more than you can afford to lose

- Go with a risk you’re comfortable taking

- Design a trading plan and stick to it

- Always use a stop loss and take profit orders

- Always use a risk tool like TradeLocker’s risk calculator

- Never let a winner turn into a loser

- Don’t trade out of emotions

- Avoid overtrading, only trade when you have conviction

- Cut losses early

- Let profits run

Tools to identify and manage risks across markets

Every market has its own intrinsic risks that you need to be aware of. And at some points, you may find yourself micromanaging risks related to a specific stock or precious metal. At other times, you may be assessing risks over a whole economy, especially if you’re looking to trade forex.

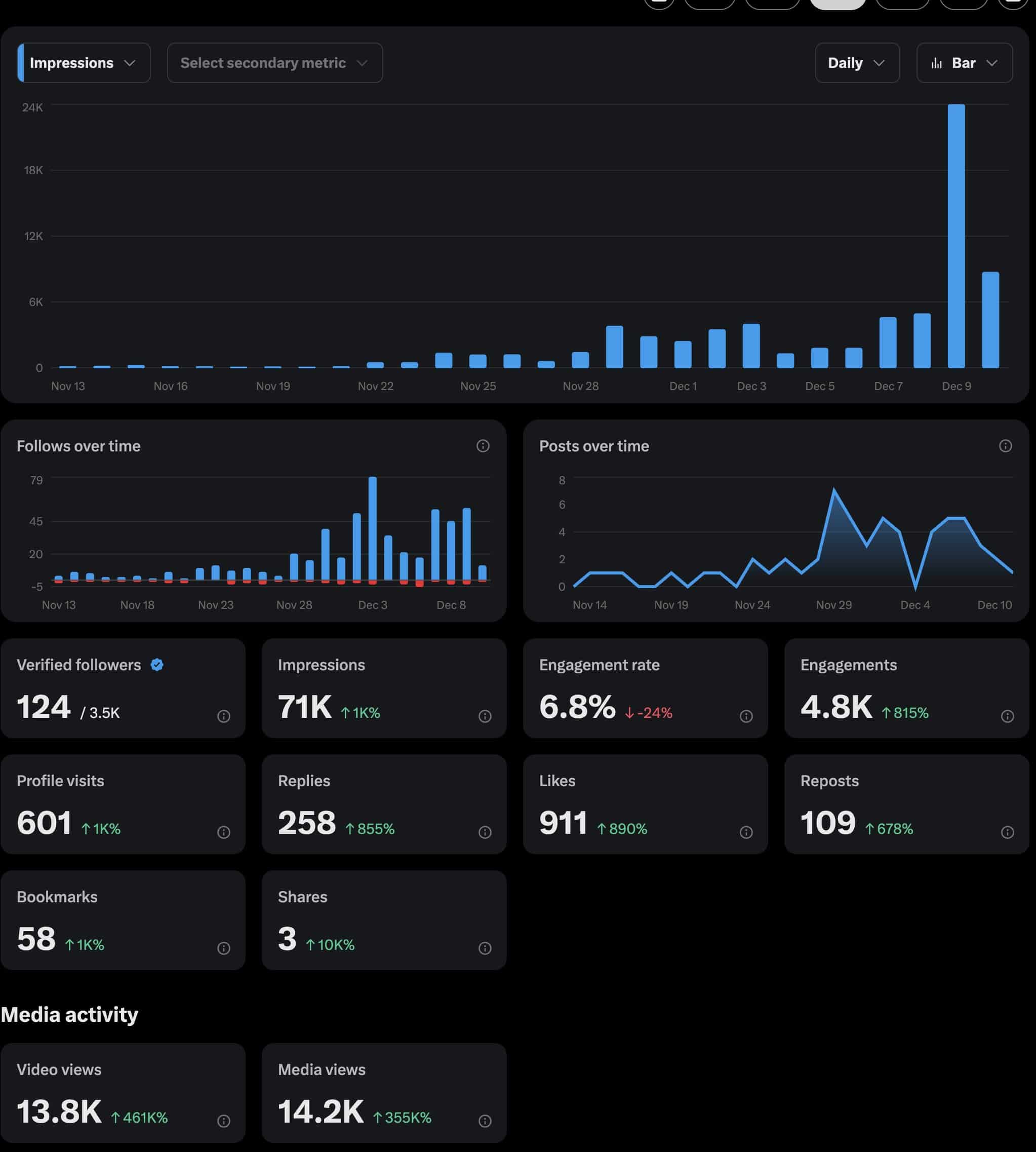

Thankfully, there is a powerful risk management tool designed to help you trade more profitably. The TradeLocker Risk Calculator estimates your entry and exit before you execute a trade so you can plan how much you can lose and how much you can profit. It’s a neat and convenient instrument that you can use virtually across all asset classes for every type of order.

Try the risk calculator today with FunderPro, our prop trading platform powered by TradeLocker technology. Sign up and buy a challenge at a 20% discount with Owen’s coupon code OWEN20.

Summary

Taking risks in trading is mandatory if you want to progress and grow, both in financial terms and personally. To this end, make sure you keep in mind the risks involved in the markets and always use proper risk management tools and techniques that will help you accelerate to higher grounds in the world of trading.